History

- In 2010, Trea AM was launched with the objective of actively manage our investors assets in order to maximize their returns. That same year, a contract was signed with MEDIOLANUM GESTIÓN, which delegated to us the management of investment funds, pension funds, SICAV, EPSV and Discretionary Portfolios.

- In 2011, we launched our first fund under our own brand, Trea EM Credit Opportunities, an emerging market fixed income fund, and in 2012, we launched the Trea RF Seleccion Fund.

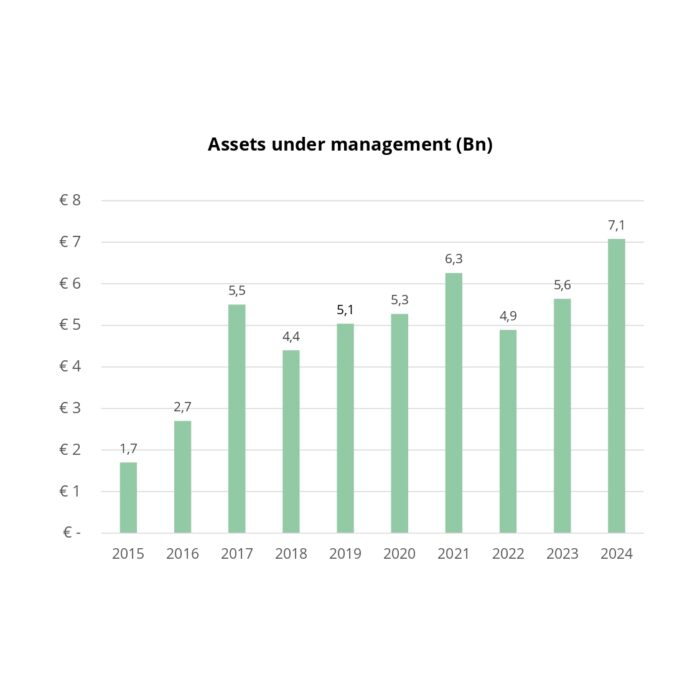

- In December 2015, we became the asset manager of the Cajamar Group with a range of multi-asset funds.

- In 2017, we focussed our efforts on launching an alternative investment fund, Trea Direct Lending. Sizing €70 million, it offered flexible financing solutions for the growth, stabilization or balance sheet restructuring of SMEs. We also launched our first equity fund, Trea Iberia Equity, which invests in Spanish and Portuguese companies.

- In 2018, to complete our range of in-house funds, we launched our first mixed fund, Trea Balanced.

- In 2020 we bought Novo Banco Gestión and we are managing their funds and pension plans.

- In 2021, we exceed EUR 6 billion in assets under management.

- In 2022, we launched Trea Infraestructura FCR, an infrastructure’s fund of funds.

2010 - 2014

Mediolanum Mandate

Trea Credit Oppotunities

Trea Renta Fija Selección

2015

Trea European Equities

Cajamar Mandate

2017

TDL I 70M

BMN Mandate

Trea Iberia Equity

2018

BMN / Bankia Merger

Trea Balanced

2019

COEM Partnership

2020

NOVO BANCO Mandate

2021

More than €6 billion under management

2022

Trea Infraestructura FCR